They say that there are only two certainties in life…death and taxes. Well, we’d like to add a third certainty to that list: inflation.

Now, death is obviously something everyone has to deal with. It’s completely unavoidable. Taxes and inflation on the other hand? Not so much. There are ways that you can navigate these destroyers or wealth using a few financially-savvy tricks. The key is to generate income for yourself that keeps up with inflation while at the same time giving you tax benefits. But we’re getting ahead of ourselves.

Let’s discuss exactly how taxes and inflation destroy your wealth and how you can fight back.

Understanding Taxes and Inflation

If you’re a working adult then we really shouldn’t have to explain what taxes are. Taxes are money that you pay to the government and they come in many different forms like income taxes, food taxes, property taxes, gas taxes, etc.

Investopedia defines taxes as “Mandatory payments collected from individuals and corporations by a government entity to fund government activity.” It’s the price you pay to live where you live and use things like infrastructure, parks, schools, etc.

On the other hand, you might not be as familiar with inflation.

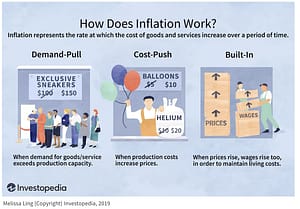

In simple terms, inflation is the slow decline of a currency’s purchasing power over time. It works very slowly, so it’s hard to see its effects in real-time. But, just like watching a weed grow, over time the effects are apparent. Inflation is the reason that a cup of coffee cost only 25 cents in 1970, costs closer to 2 bucks today, and could very well run you $5+ a few years from now.

An increase in the supply of money by the government is the root cause of inflation. Either through printing money or through loaning new money into existence by purchasing government bonds from banks. Both cases decrease purchasing power.

However, there are a few other ways that price inflation can occur.

The important thing to remember is that inflation eats away at the value of your cash. This loss of purchasing power will affect your cost of living if you don’t take steps to counter it.

How Do They Impact Your Wealth?

Both taxes and inflation are expenses that everyone has to pay. And there are many ways in which they can eat away at your net worth. For example, if you don’t take measures to reduce your tax bill then you could be stuck paying 15% (the most common tax bracket) of your income to the government for life. Without proper tax planning, the more income you earn the more you will pay taxes.

Inflation is another factor that can eat away at your wealth over time.

For example, the inflation rate today is much higher than normal mostly due to COVID-19.

During the lockdown, there were major slowdowns across the whole supply chain. At the same time, the government was issuing stimulus checks and decreasing unemployment to combat the financial impact. When the economy slowly started recovering, the demand for goods outpaced the supply of goods. Causing a hike in inflation that we haven’t seen since the early 1980s.

Inflation is increasing the cost of living and making the world around you more expensive.

How Do You Avoid Them?

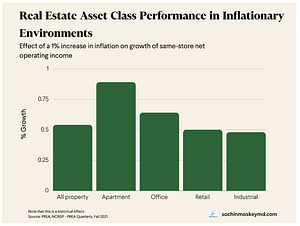

If you were guaranteed that your wages would be increased each year to keep pace with inflation then it might not be so bad. For example, if inflation was 5% and your employer guaranteed you a 5% wage increase then you would still be breaking even each year. But, this is rarely the case. Therefore, the only way to fight inflation is to make more money. This is why so many investors invest in real estate.

There are three ways that real estate can fight inflation:

- Appreciation: The asset that you buy will most likely increase in value over time. Sometimes, this price appreciation alone is enough to offset inflation.

- Cash flow: In addition to appreciation, you can also generate cash flow from your property by renting it to a tenant. When inflation increases, you can raise the rent to cover the increased cost of inflation.

- Debt depreciation: Inflation also works on debt. Let’s assume that you have debt service on a property of $2,000 per month (which doesn’t change) and the rate of inflation is 5%. After 5 years, this payment is really only worth $1,548 due to inflation.

This is just one example of how investing in real estate can help you keep pace with inflation.

Real Estate and Taxes

Real estate can also give you plenty of tax advantages, such as depreciation.

Depreciation is the process used to deduct the costs of buying and improving a rental property. As a real estate investor, you can legally use depreciation to lower your taxable income and possibly reduce your tax liability and expenses. Additionally, you are allowed to take the depreciation deduction for the entire expected life of the property. Right now, this is 27.5 years for residential properties and 39 years for commercial properties.

Real estate investments are great assets to hold in your portfolio for their ability to fight both inflation and taxes.

By making smart financial and investment decisions you can worry less about inflation and taxes and start feeling secure in your financial future.

Land is Limited

Real estate is one of the few resources out there where they truly are not making any more of it. The land that’s out there is all there is. For this reason, real estate also holds intrinsic value due to its scarcity. This is especially true for property in urban areas where there is a lack of available land to build on. If you own property in a popular area, its value should increase over time. Again, this helps you beat inflation.

Even the famous poet Mark Twain advised his readers to, “Buy land, they’re not making it anymore.”

We hope that you’ve found this article valuable when it comes to learning about the two biggest destroyers of wealth: inflation and taxes.

If you’re interested in learning more please subscribe below to get alerted of new articles as we write them. Also, please follow along with Avatar Equity and Sachin Maskey on social media to get alerted of any updates.

Sachin Maskey is a physician, real estate investor, philanthropist, and entrepreneur. He has over 17 years of expertise in the medical industry as a family medicine specialist. Outside of medicine, he is the founder of the commercial real estate investment firm Avatar Equity as well as the Dhana Yoga Foundation. You can follow along with Sachin on Instagram, TikTok, Facebook, and LinkedIn.